It is different from the specialized journals like sales, purchase etc, where only items related to them are recorded. It mainly keeps the details of five major accounting heads which are assets, liabilities, revenue, expense and capital. It is necessary that a business continues to maintain its general journal and make accurate entries regularly so that all its costs may be realized and all funds may be allocated as needed.

To Ensure One Vote Per Person, Please Include the Following Info

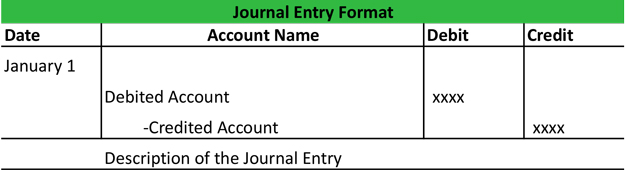

- The debit part of the entry is first written and the credit part of the entry is written below the debit part.

- For example, expenses are increasing in debit, and revenues are increasing in credit.

- To complete an entry in a general journal, one would write a journal entry as usual.

- Accounting journals are often called the book of first entry because this is where journal entries are made.

- Finance Strategists has an advertising relationship with some of the companies included on this website.

There are some accounting debit and credit rules to have in mind when using a general journal. In the general journal, there may be multiple debits or credit entries. However, the sum of the debits must always be equal to the sum of the credits. When making an entry you must always debit the receiver and credit the giver.

Why You Can Trust Finance Strategists

Following these steps ensures that entries are recorded accurately and efficiently. Common examples include adjusting entries, closing entries, and compound entries. Adjusting entries, for example, are crucial at the end of an accounting period to ensure that the financial statements reflect the true financial position of the business. Once the journal entries are posted to the ledgers, the posting reference column can be filled out with the ledger number or abbreviation that the entry was posted to. The ledgers can then be used to make a trial balance and eventually a set of financial statements. Now that these transactions are recorded in their journals, they must be posted to the T-accounts or ledger accounts in the next step of the accounting cycle.

Create a Free Account and Ask Any Financial Question

Hence, the PR column is used to state what page the information was copied to when the financial transaction was recorded on the journal ledger; which has information about separate accounts. That is, the page number of the ledger account to which the entry belongs is written in the posting reference column. For instance, if the cash account is on page number 99 in the ledger, the number 99 would be written in the posting reference column where the cash account appears in the general journal. As you can see, each journal entry is recorded with the date and a short description of the transaction. Also, the debits of each transaction are listed before the credits in each transaction.

What are debit account and credit accounts in General Journal?

It is the first place where transactions are recorded according to their dates. Therefore, the general journal is a diary of the business’s transactions. All journal entries are periodically posted to the ledger accounts. In the posting reference column, the page number of the ledger account to which the entry belongs is written.

Accounting Ratios

It is common to leave some space at the left-hand margin before writing the credit part of the journal entry. The year, month, and date of the transaction are written in the date column. It is written once per page (i.e., it does not have to be repeated for every entry on the page). Let’s consider a few different transactions to illustrate how they might be recorded in the general journal. Entry #4 — PGS purchases $50,000 worth of inventory to sell to customers on account with its vendors.

Accounting journals are often called the book of first entry because this is where journal entries are made. Once a business transaction is made, the bookkeeper records that event in the form of a journal entry in one of the accounting journals. Then, at the end of a period, the journals are posted to accounting ledgers for reporting purposes.

With the advent of computerized accounting systems, the use of physical books of accounts was virtually eliminated. Electronic spreadsheets and even cloud-based databases became mainstream while physical records were already considered a thing of the past. Expenses are increased in debit, so we need to debit subleases and subtenants the amount when we record it in the journal. If the entity pay by cash, then credits the same amount to cash. If the bank pays it, then we should credit the same amount by banks. After making entries in the general journal format in accounting, all the transactions are summarized and posted in the ledger.

There are three types of accounting journal – general journal, combination journal and special journal. Each type has specific uses but all of them are considered books of original entry since they serve as initial records of transactions that enter into the accounting system. A specialty journal records special events or transactions related to the particular journal. There are mainly four kinds of specialty journals – sales journal, Cash receipts journal, Purchases journal, and cash disbursements journal.